Exactly on December 12, 2016, I wrote an article predicting that Dubai is going to see its economic fall. I even gave the dates that it may happen by 2018. Here we are in 2018 and Dubai’s economy has started to melt like an ice cone in a hot summer day near Jumeirah beach.

Let’s examine how ?

Dubai, is a city where I have lived for several years. Established and ran businesses in. I understand the economic environment and it’s financial structure. The financial structure is connected to its economic structure in the most strangest manner, a phenomenon not found in many cities of the world. The phenomenon of

“I OWE YOU and will pay you later”.

And this comes in the form of a “Post Dated Cheque”. Nobody asks you before gladly receiving that cheque from you, what would happen 8 months from today if your business has collapsed or sees a cash crunch. How will you honour your cheque. You are not dealing with a bank that you have given the cheques to, with a huge ability of financial sustenance.

Your cheques are mostly to other businessmen who write cheques to their creditors based on your post dated cheques. I owe you on top of I owe you multiplied by the umpteenth factor. No economy can develop and sustain on this principle. Simple as that. One business man in the chain defaults, the entire chains is broken. The biggest of the companies can face a downturn and their cheques can bounce. And the strangest thing is that if your cheque bounces you are not given a chance to even negotiate the payment with a little more time. A complaint is lodged and the businessman arrested. Or to avoid the arrest, the businessman flees Dubai leaving the entire business to collapse and not a single chance of recovery for the receivers of the cheques.

Abraaj Capital had a $48 million dollar cheque bounce two weeks ago.

You think that’s was a big cheque. Wait till you read this. From January 2018 to the end of May 2018, 26 billion dirhams worth of cheques have been bounced. 1.2 million cheques in total. Or 39.3% of the total number of cheques issued in 2017 which were to come due in 2018. They came due and they bounced 39.3% is not an amount to be taken lightly, neither is the number of checks that is 1.2 million nor the amount of 26 billion dirhams, that’s $7 billion dollars in just 6 months of 2018. This will cause the coming 6 months of 2018 from June to December to cause a disaster in the making to be dealt by the authorities with no recourse. And the reason I said no recourse is because you need to see by researching other related clues in order to establish if the people who have written the cheques are still in Dubai or most of them have fled the city.

Also See: Pakistan Is About To Collapse. #MirMak

You need to look at two things if you want to do related research to establish the above point if the people have fled Dubai or not. First, if their phones connections are cancelled. And Second, if they have fled with their families. Best thing to look at to see the second part is to see as to how many children have been withdrawn from their schools. Let’s look at the biggest phone carrier of Dubai, Etisalat and it’s data. 32,000 phone connections were cancelled between March and April of 2018. Just in 38 days in total. Mobile phone connections that is 28,000 children were withdrawn from schools without registering themselves for the end of summer sessions. Meaning those families do not plan to come back.

I wish it ended here. I wish the signs were not as obvious. But they are. Dubai property that used to be sold at 2300 dirhams per square foot is selling at less than 600 dirhams per square foot. Or in simple words, it’s selling at 25% of its value.

Gold Souk has empty stores for the first time in 35 years. You could not find a single empty store to rent or buy earlier. Arabian Center, Sunset Mall and Al Ghurair have stores shutting down every week. Emirates Towers with the most chic restaurants is witnessing a closure upon closure of restaurants. Hotels have cut their average price to 30% of what they used to charge and last month alone 18 hotels shut down including Savoy, Ramada, Richmond, Crest, Jarmond and the list goes on. Lamcy plaza, one of the most busiest malls had a fire and was supposed to be opened in August 2017 and it’s still closed down. Bur-Juman and Wafi Mall have the highest vacancy rates of shops. The list can go on and on and I can pen down more signs of an economic meltdown than you can read.

Abraaj Capitals’ collapse is a nail in the financial system coffin of Dubai. The biggest confidence eroding incident ever to have taken place in the history of Dubai’s financial system.

The point is not to sit and laugh at what has happened. That is cruel and arrogant. Livelihoods have been lost and families have been ruined. The point is for other counties in the GCC to stop this post dated cheque based economic model immediately before they face the same fate. And for the businessmen the lesson is to develop a sustainable business model where your freedom is not hinged upon one bounced cheque. Because anybody’s cheques can bounce unintentionally and based on unforeseen circumstances.

With the OECD restrictions, Anti-Money Laundering initiatives around the world. FATF watching. Counter Terrorism financing watchdogs sifting through every transaction. The biggest appeal of Dubai will be dead as well. The appeal of having unquestioned transactions for the world’s corruptly earned funds.

This is a bad cycle that Dubai is going through where in my opinion the bottom of which we have not seen yet. Nowhere even close to it. With media censorship and controlled release of any and all news, you will not even hear these stories in Dubai. Unless you want to be a journalist who loves jail food.

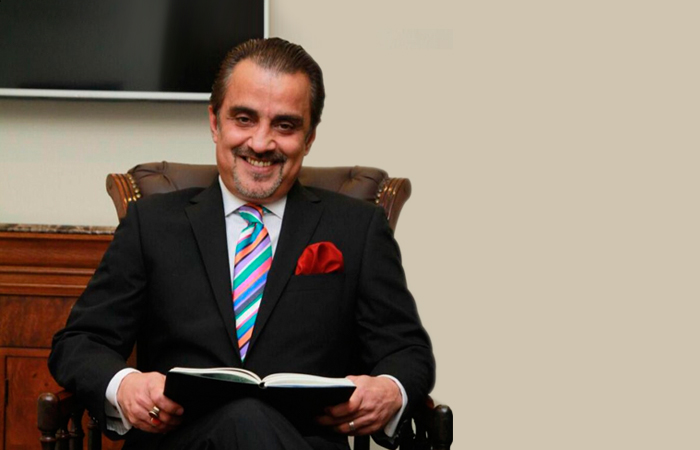

This is guest article by Mir Muhammad Ali Khan.

Mir Mohammad Alikhan is internationally renowned Investment Banker, Entrepreneur & Capital Markets Advisor. At the age of 29, he became the youngest Chairman and Founder of a Full service Investment Bank in America and the first Muslim to have owned an investment bank on Wall Street. He has had a successful career as Founder & Chairman The Financial Group, Inc., Federal Advisor to Govt. of Pakistan, a Member of New Jersey Governors Council, a Senior Advisor to New Jersey State Mayors and US State Senators. He introduced Islamic Banking Research into mainstream America by co-sponsoring and advising Harvard University to launch Harvard Islamic Finance and Information Program (HIFIP).

He also developed “THE WORD’S FIRST ISLAMIC BANKING BENCHMARK INDEX on WALL STREET Named:KMS-SAMI: (Socially Aware Muslin Index) Which Is Now A Functional Index Run By The Dow Jones Indices. He has also been featured in “Who’s Who of Top Executives in the World”. Featured in “Humans Of Pakistan” and in 2015 he became the first Pakistani ever to have a movie produced on his life through a first time co-production of Hollywood and Pakistani production house Sermad Films, The Producers of the movie “JALAIBEE”.WWW.MIRMAK.NET/Biography