A $110 Billion Surge Under Scrutiny

Alibaba Group Holding Ltd. is set for a crucial earnings test on Thursday, following a rally that added over $110 billion to its market value. This surge, driven by enthusiasm around its AI model DeepSeek, co-founder Jack Ma’s engagement with top officials, and a partnership with Apple Inc., has propelled Hong Kong-listed shares nearly 60% higher from their January low. However, concerns remain about fierce competition and China’s struggling economy.

Market Expectations and Valuation Surge

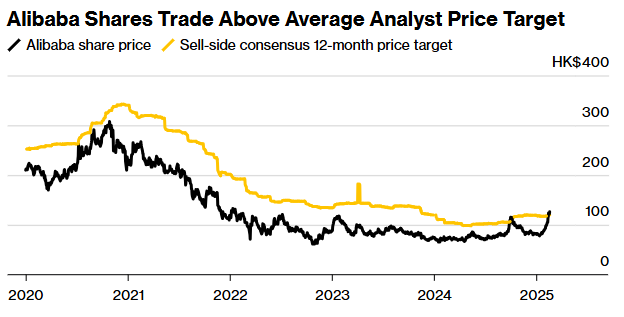

Options traders are anticipating a stronger-than-usual stock reaction to Alibaba’s earnings results. Shares have surpassed analyst price targets, reaching their highest earnings multiple in two years and trading at technically overheated levels.

According to HSBC analyst Charlene Liu, Alibaba must refocus on fundamentals to sustain its momentum. This includes stabilizing e-commerce market share, developing a clear AI monetization strategy, and driving cloud revenue growth with improved margins.

Alibaba Shares Ahead of Analyst Targets

Despite the excitement, Alibaba shares dropped as much as 4% in early trading on Thursday ahead of the earnings report. The AI-fueled rally has sparked hopes that growing AI adoption will boost demand for Alibaba Cloud’s services. The stock is now trading at around 13 times estimated forward earnings—up significantly from less than 9 times just a month ago.

Xiadong Bao, a fund manager at Edmond de Rothschild Asset Management, suggests that Alibaba’s valuation could return to its five-year average of 15 times forward earnings if its AI narrative continues to gain traction. However, potential risks include upcoming government policy announcements and the impact of new U.S. tariffs.

Read More: Alibaba launches new AI version ‘better’ than DeepSeek

A High Bar for Earnings Performance

Investor expectations are sky-high, as seen in the negative market reaction to Baidu Inc.’s recent earnings. Despite strong AI cloud growth, Baidu’s stock fell due to concerns over weaknesses in its core search business.

For Alibaba, investors will be closely analyzing its ability to capitalize on AI-driven demand while maintaining profitability amid price competition from rival cloud and e-commerce providers. Analysts estimate that sales for the December quarter rose by 6.5%, marking a notable increase from both the previous quarter and the same period last year. Additionally, the net adjusted profit margin is expected to improve to 16.6%, up from 13.2% in the September quarter.

Cloud Business in Focus

Alibaba’s cloud division is expected to be a key earnings driver. Analysts predict a 9.7% revenue increase for the latest quarter, up from 7% in the previous period.

Meanwhile, daily options trading volume has surged to over 180,000 contracts in the past five days, compared to a 20-day average of around 110,000. Traders are positioning for a 6.1% stock movement post-earnings, exceeding the 4.8% average seen over the past eight quarterly reports.

Competitive Pressures in AI

Investors will also be looking for signs of how Alibaba plans to fend off competition in the AI sector. While DeepSeek demonstrates how AI costs can be lowered, it also raises concerns about new players entering the market more easily.

“Alibaba is a major AI player among China’s blue-chip firms, but it still faces strong competition from Baidu, Tencent, and Huawei,” said Manish Bhargava, CEO of Straits Investment Management. “Alibaba Cloud has significant potential in AI infrastructure, but its success will depend on execution, regulatory factors, and market adoption.”

As Alibaba navigates these challenges, Thursday’s earnings report will be a crucial moment in determining whether the company’s AI-driven surge can be sustained.